Introducing our very own in-house built

EMMI Platform

Emmi is a game-changing platform that makes coding easy and API integration a breeze. With our intuitive interface, you can create and manage your own APIs without any hassle, saving you time and money. Whether you're a developer or a non-technical user, our platform is designed to be user-friendly and accessible to everyone. Plus, with our focus on security and reliability, you can trust that your APIs and data are safe and secure.

Contact us today to see how Emmi can revolutionize your development process!

Our Products

With a lot of Powerful Features, We guarantee Simplicity and Clarity

eCommerce Shopping

Take advantage of direct sale opportunities via your eCommerce website and sell your products from any device...

Hotel & Guesthouse Booking Platform

Partnering with us will allow you to convert visitors to loyal customers by allowing them a frictionless...

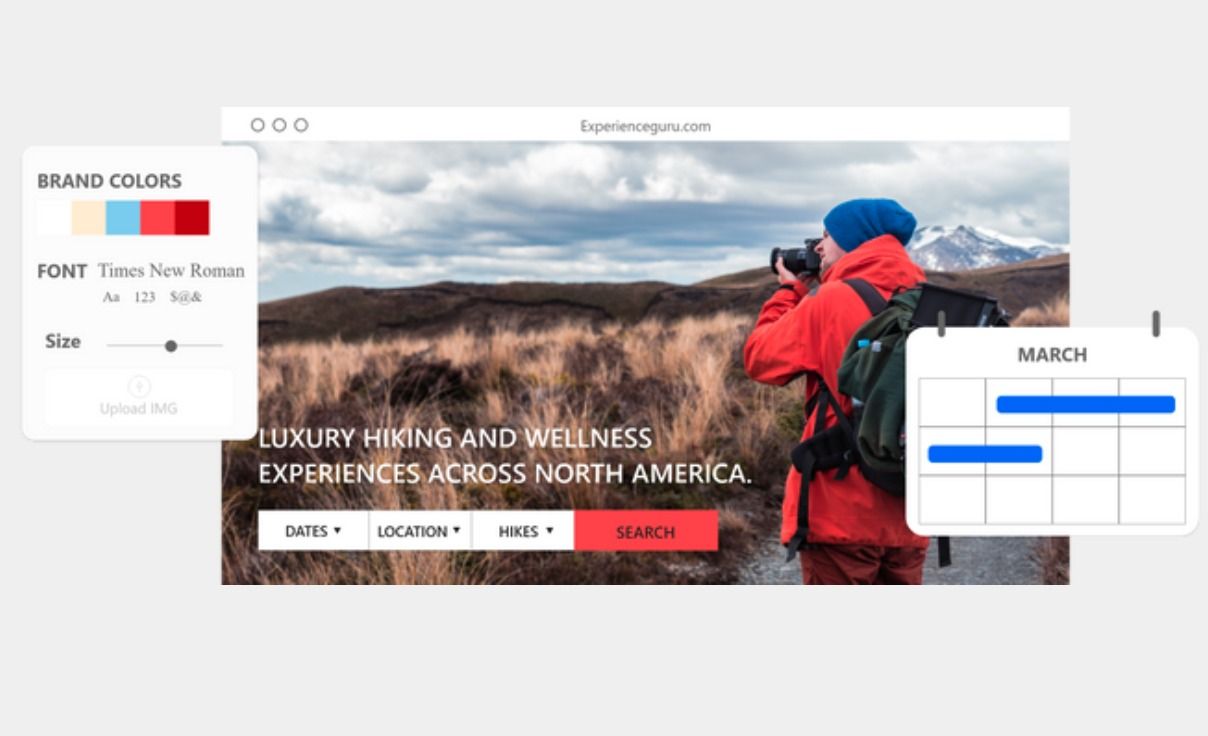

Activities Platform

At a fraction of the cost, you can start selling online or add advanced functions to your website by working whit our experienced team...

PMS and Channel Management

You can coordinate reservations, online bookings, and other business operations...

SEO & Digital Marketing

Optimizing your SEO presence and building the organic value of your website...

Content Writing

Hire our writers and marketers to handle the time-consuming task of writing website content...

Outsource Booking Office

We offer seamless online bookings, supported by excellent back-office management.

GET YOUR BUSINESS ONLINE

Through Go4IT Africa's platform, guests can book direct travel and make payments via a mobile app or website.By not using iframes, widgets or "Book Now" buttons, we don't redirect users away from your website. Thus, we help you gain all of that powerful SEO authority from those expensive marketing campaigns.

Who We've Worked With